ISDA SIMM Performance for Portfolio

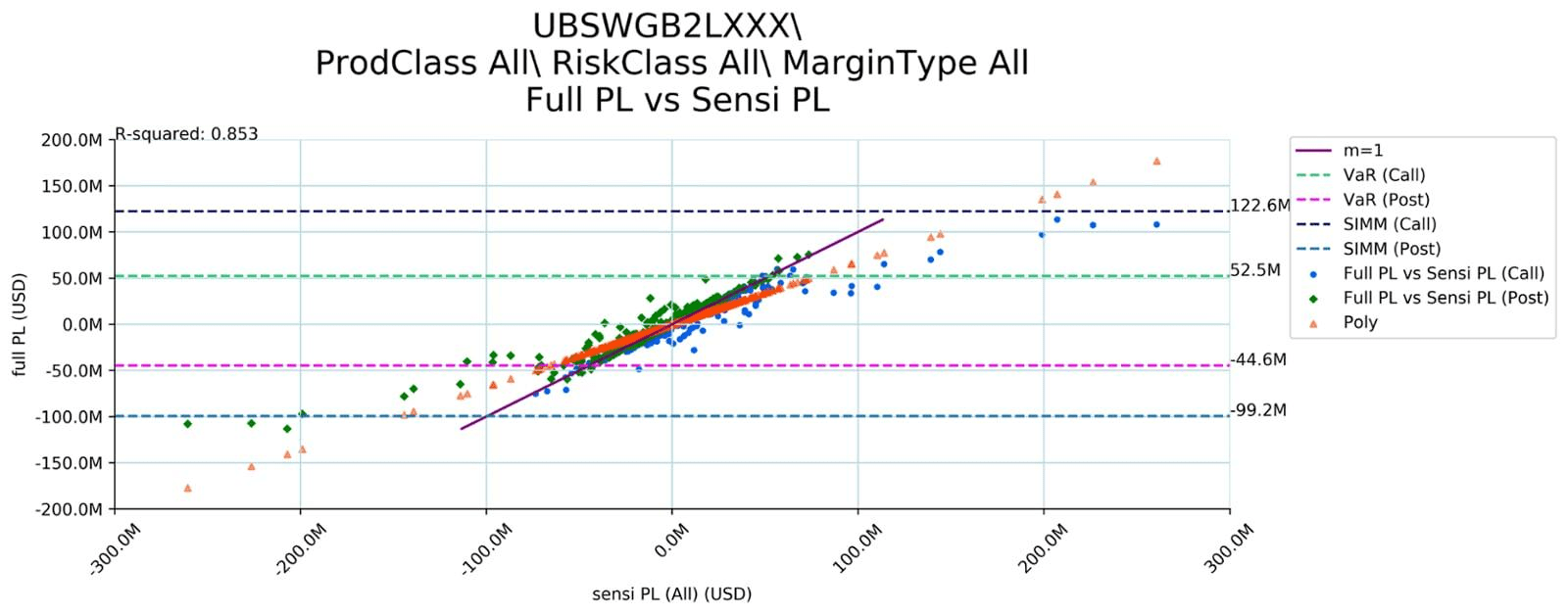

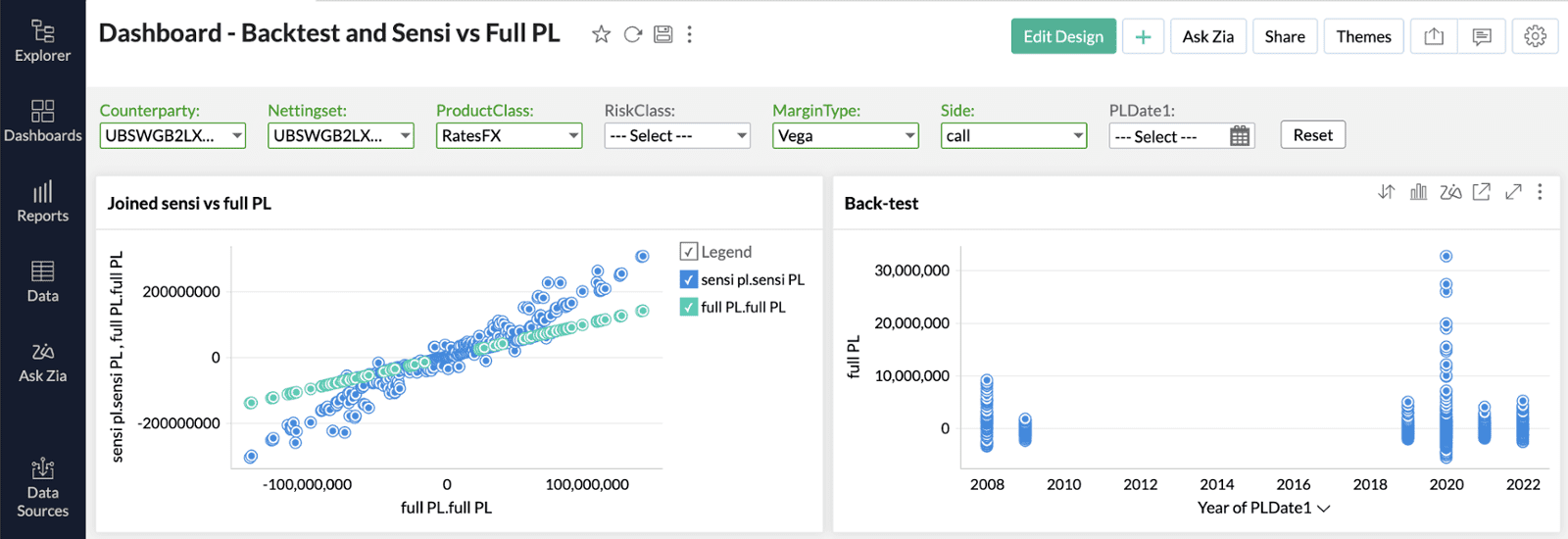

Datalysis' SIMM Performance Analysis Tool (S-PAT) provides an analysis of the performance of ISDA SIMM against real PL across differing market conditions for a given portfolio. It helps identify those market conditions where IM shortfalls are likely to occur.

S-PAT can drill down to individual instrument to identify market conditions where convexity, term-structure, translation exposure etc cause ISDA SIMM to poorly estimate real PL.

S-PAT assists phase 6 organisations to:

- Respond to section C of APRA RFI

- Understand the behaviour of new derivative product prior to their introduction

- Identify weakness in ISDA SIMM for quarterly or annual portfolio reviews

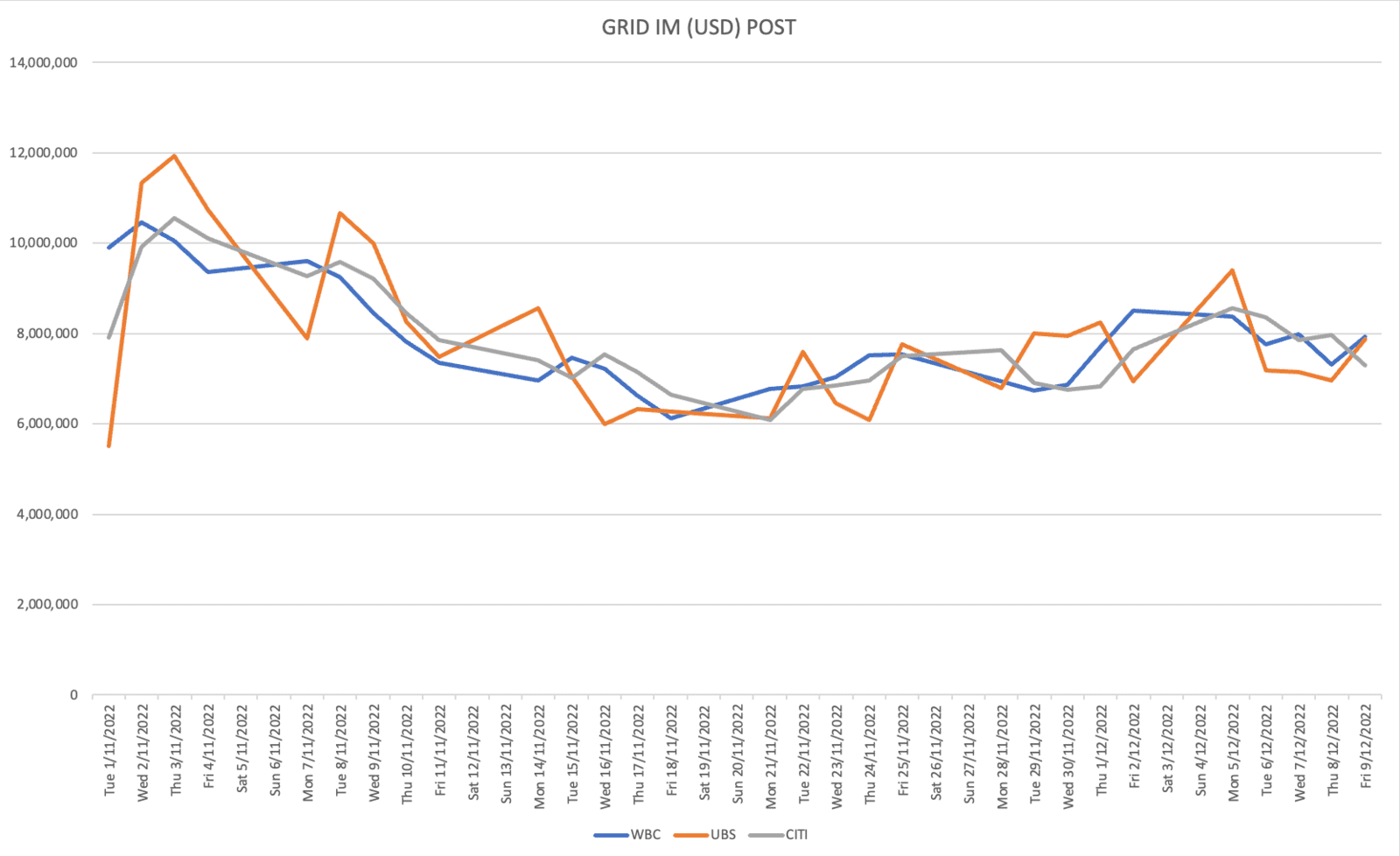

Initial Margin using GRID

The Datalysis GRID engine allows clients to upload their derivative portfolio and determine their initial margin per netting set (counterparty) and in total under the GRID methodology. JP Morgan and CFTC trade file formats are supported but any format containing the appropriate information will do.

The Datalysis GRID engine also includes trade level netting which may benefit some clients.

Bespoke Development

Datalysis can also undertake custom development of tools for clients either on our platform or on the client's.

We can assist clients to develop tools for areas such as:

- Derivative risk analysis

- Challenger model development

- Performance attribution